New Brunswick, NJ | December 12th, 2022

Octaviant Financial (OFX) is pioneering the use of innovative warranty structures with biopharmaceutical companies to ensure the performance of high-cost gene and cell therapeutics (GCTs). When structured properly, therapeutic warranties are the most efficient vehicle for manufacturers to refund payers should a single dose therapy fail to benefit patients. To further bridge the gap of innovative therapies between patients, payers, and biopharmaceutical companies, Octaviant is announcing the OFX Loan, a proprietary payment plan for biopharmaceutical companies to offer payers to make high-cost therapies accessible.

Octaviant’s financial and insurance products leverage the latest guidelines from the CMS 2020 Final Rule to bring its therapeutic warranties and innovative financing arrangements to market. The OFX Loan’s key proprietary feature is that it is designed to be transferrable from payer to payer.

The terms of an OFX Loan can be competitively set by manufacturers to meet the needs of payers. Octaviant is planning a program for payers to establish an OFX Loan directly with Octaviant and pair it with a warranty that is backed by the manufacturer or a third-party. Alternatively, the OFX Loan and associated warranty can be integrated directly into traditional and novel stop-loss coverage.

A specialized loan and warranty helps payers, providers, and biopharmaceutical companies manage the up-front cost of innovative therapies. This will expand patient access to life-changing treatments while providing tremendous savings to the healthcare system in the long run.

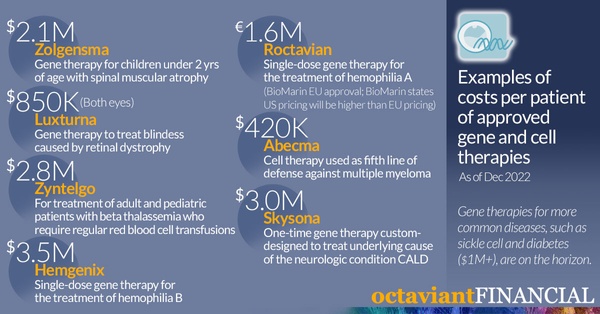

"As the number of gene and cell therapies (GCTs) approved by the U.S. Food and Drug Administration (FDA) to treat orphan diseases and prevalent indications increases over the next decade, the economic burden placed on health benefits payers will grow substantially as the costs of these therapies often exceeds $2 million,” said Emad Samad, CEO of Octaviant Financial. “Fortunately, the CMS 2020 Final Rule on therapeutic warranties and installment plans gives payers and manufacturers very powerful tools to reduce both the risks and costs associated with these therapies in ways traditional Outcomes Based Agreements could never do. Middle market self-insurers with beneficiaries who would benefit from GCTs will be the most impacted through their obligation to cover these therapies."

The OFX Loan and Warranty are structured such that both are portable. Should a beneficiary move from one plan to another, the warranty and all or some of the remaining loan obligation associated with the high-cost therapy can transfer with the beneficiary to the new plan.

Each use of an Octaviant Financial product by a manufacturer will vary across indications due to the nature of the therapeutic agent, the competitive landscape, clinical trial results, or pricing dynamics, among many other factors.